Do I pay tax if I take money out of my business bank account?

Tom Irwin • August 10, 2022

- The short answer is no.

- This is a very common question we get asked and the source of regular confusion.

- You pay income tax on the taxable profit your trading entity makes, be it as a sole trader or a Company or Trust.

- If you take money out of your business account for private purposes it is referred to as drawings. If you put money into your business account from a personal bank account it is called funds introduced or capital introduced. All of these transactions- all the ins and outs - make up your current account. If you take out more money that you put in, your current account will be overdrawn, in which case you “owe” the business money.

- Often when a business is starting out, or if the business is struggling for cash, the owner(s) will put some of its personal money into the business. This is essentially a loan, commonly referred to as a shareholder advance if it is a company. When the entity pays this back to the owner it is just paying back the loan/advance.

- Generally, as long as the current account is not overdrawn, there are not any income tax issues associated with that transaction.

- If the trading entity is a company and the shareholder has an overdrawn current account, they are liable for interest on the overdrawn current account, otherwise this could be considered a deemed dividend. This is starting to get a bit more complicated. Essentially, if current accounts are being overdrawn, it means you are taking out more money than you have put in, so you are potentially taking out working capital that should be used for GST or paying creditors.

- Another common issue for companies that are doing well is that the shareholders keep drawing cash in lieu of a dividend and then retrospectively a dividend has to be declared to ensure the current account is not overdrawn at the end of the financial year. This is ok, but it pays to talk to your accountant in advance if you plan to take large amounts of cash out of the business for private use, over and above your salary.

- Remember - you get taxed on your profit, not your drawings. It is possible to draw more than you earn, but if this is the case you are probably taking working capital out of the business.

Disclaimer: This post is a general discussion and does not constitute specific advice. Any concepts or ideas raised in this post should be discussed with your accountant and/or solicitor to ensure that all relevant matters are considered.

Firstly, a bit of background. Family trusts are a way to protect assets, either for your own benefit or for the benefit of your family or others beyond your lifetime. The assets may be cash or other types of assets such as real estate, life insurance, vehicles and securities. Trusts work by transferring the ownership of the assets to trustees. For example, a family that lives in a family home transfers the legal ownership of their asset, the family home, to the trustees. The family can continue to use and enjoy the assets (as long as allowed by the trust deed) even though they no longer personally own the home. A trust may be useful to: • Protect assets against future claims and creditors, such as if a business failed • Put aside money for a special purpose, such as a child's education • Ensure children, and not their partners, receive their intended inheritances • Reduce the risk of unintended claims on an estate in the event of death. While trusts can have benefits, they can also involve a considerable amount of resources in administering them properly. This needs to be weighed against any possible advantages a trust may have. Although a trust is normally given a name and is often referred to as if it is a separate entity, like a company, it is not. A trust is a relationship between trustees and beneficiaries which imposes duties on the trustees to deal with the trust property in the interests of beneficiaries. I'm a Trustee - what are my obligations? The trustees are responsible for managing the trust for the benefit of the people (or organisations) named as the trust’s beneficiaries. In practice, this can often involve some fairly time consuming obligations. Trustees can also be held personally liable - so tread with caution! Specifically, the legal duties of trustees are to: • know the terms of the trust, as recorded in the trust deed, and act according to those terms; • act honestly and in good faith; • act for the benefit of the beneficiaries; • exercise their powers as a trustee for a proper purpose; • keep copies of the trust deed and any variations; • give basic trust information to every beneficiary (including the fact that they are a beneficiary; the names and contact details of the trustees; details of the appointment, retirement or removal of trustees, and their right to trust information.) Unless the trust deed specifically excludes it, legal duties also include: • using reasonable skill and care when managing the trust, using any special knowledge or expertise they have eg, as a lawyer, accountant; • investing the trust assets prudently; • acting unanimously; • not using their power as trustee for their own benefit; • acting impartially between beneficiaries; and • not taking any reward for their duties (it is acceptable to be reimbursed for costs). Additional obligations may be set out in the trust deed. A trustee may be personally liable for debts incurred by the trust, especially if the loss was a result of an intentional breach of trust, dishonesty, or negligence. How can we help? We regularly help to advise clients on whether a trust is right for them. For clients that are trustees, we can help them meet their obligations. Some trusts are relatively simple to administer properly, while others that are more complex require a great deal of time and care from the trustees. A trust with one asset, such as a mortgage-free family home, with all outgoings paid by the family, would generally only need minimal administration. On the other hand, a trust with a range of assets, including income-producing investments, would require a lot of administration. On top of completing an annual tax return, the trustees would need to undertake, for example, periodic reviews of investment strategies and continuous maintenance of the assets themselves. We are experienced in advising on such issues and are always available to assist. Disclaimer: This post is a general discussion and does not constitute specific advice. Any concepts or ideas raised in this post should be discussed with your accountant and/or solicitor to ensure that all relevant matters are considered.

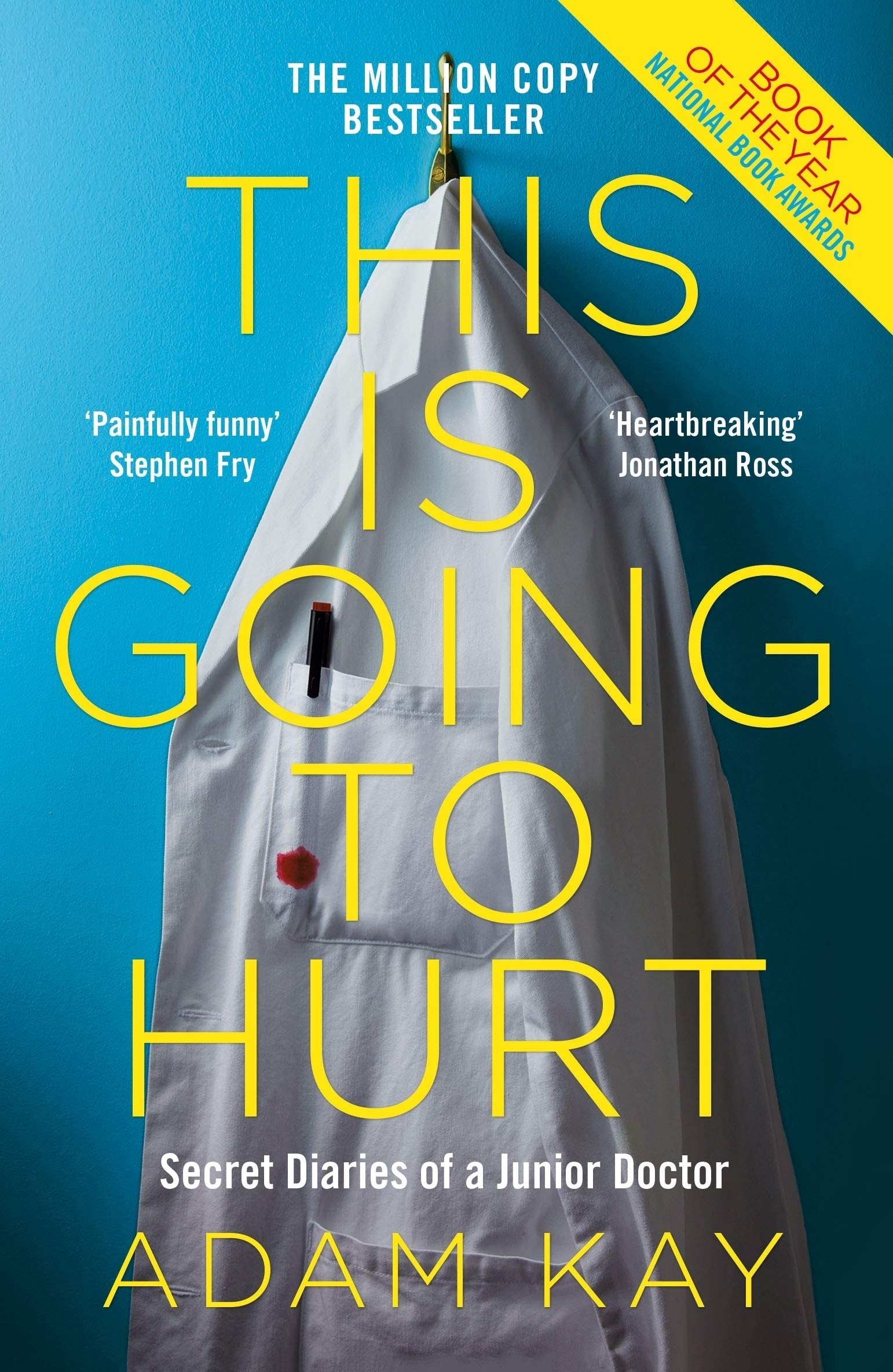

If you haven’t joined the hordes of readers yet – an estimated 2 million copies have sold – now is the time. Title: This is Going to Hurt: Secret Diaries of a Junior Doctor Author: Adam Kay Published: 2017 Adam Kay is a British writer and comedian who used to be a doctor before life in the NHS made him reconsider his career choice. He now says he would advise any children he has in future against going into medicine. The book is superbly written as a part hilarious, part horrifying insight into the day-to-day life as a training doctor in the UK. I laughed many times and was devastated when it was over, both because of how brutally Kay portrayed his experiences and because I didn’t want the book to end. It is difficult for someone who has never worked in a hospital setting to comprehend how one person could encounter so many hilarious, shocking and eye-popping instances of humanity. Is this guy for real? But it seems it is all true. Kay takes great pains to write honestly and openly about his experiences. It is not a highly technical account. Kay spends his first few years encountering the full spectrum of health issues and then trains in obstetrics and gynaecology as a specialty. It is here that the toll of an overburdened, under-resourced and unsupportive system becomes too much. If Kay hadn’t quit his career there’s no doubt he would have refrained from publishing such a scathing account of his experience in the NHS. Reading this book begs the question: what would a New Zealand version look like? Kay’s subsequently published companion book, ‘Twas the Nightshift Before Christmas, is also highly recommended. It is a much slimmer volume but well worth it for the inclusion of the stories which Kay said he’d been told by his publishers were too rude to put in his first book. Rating: 9.5/10 When to read or not to read? Not in public. I agree with one review which said the book “will make your eyes water…and it may well make you choke on hot tea”. It’s also not for the closed minded or squeamish; I refrained from sharing our copy with my parents. Rachel Irwin

Time to have a break from tax law and share some non-fiction we’ve been enjoying. Title: Mind That Child Author: Dr Simon Rawley Published: 2018 Dr Simon Rawley is a leading New Zealand paediatrician and was the senior consultant neonatologist in Auckland for a number of years. Having had a baby girl in NICU ourselves, Rawley’s experiences struck a chord. Rawley is New Zealand born, and trained in Dunedin and Christchurch before going on to complete his postgraduate study at Oxford. Alongside his work at Starship and the Auckland NICU, he ran a general paediatrics private practice in Auckland for 30 years. Rawley relates gripping stories of his career: the ethical dilemmas of neonatal care; foetal alcohol syndrome; autism and other conditions; and how trauma affects childhood development. The account of his long-distance care of Russian orphans was fascinating. Rawley’s tone is digestible and warm and I raced through this book. His passion for children is evident throughout, despite the trials endured over a long medical career. I found the entire book compelling. Rating: 8/10 When to read or not to read? Don’t read while expecting a baby or with a newborn at home unless you want to be kept awake at night (sleep is precious!). If you’re already an anxious parent it might be best to steer clear. Rachel Irwin

Figuring out how GST affects buying and selling property can be complex, and the consequences of getting it wrong can be costly. ADLS/REINZ issued the latest edition of the Agreement for Sale and Purchase of Real Estate late last year and it contained a number of changes that can affect how GST is treated. Property transactions involve three possible GST rates: 1. No GST 2. Zero rated GST 3. 15% GST Knowing which rate affects your transaction depends upon factors like the GST status of the parties to the sale and whether the land has been, or will be, used for a taxable activity. It is worth involving your solicitor and accountant early to mitigate any potential issues. Before you sign a Sale and Purchase Agreement, always ensure you have a thorough understanding of any GST implications to accurately complete Schedule 1 (GST Information). In residential property transactions where neither the vendor nor the purchaser are GST registered , no GST will apply. However, if you’re in the business of buying, selling, developing or building residential properties you may need to register for GST. This may also include if you have a pattern of buying or selling residential properties. Generally, if both parties are GST registered the sale will be Zero rated. You must register for GST if your annual turnover in the previous 12 months was more than $60,000 (or is likely to be more than $60,000 in the next 12 months). Turnover is the total value of supplies made for all your taxable activities, excluding GST. Your turnover must include the sale of any residential property sold as part of your taxable activities. Short stay accommodation Although most residential property transactions do not involve paying GST, be careful if you think you may use the property for short stay accommodation in the future, such as through AirBnB. This activity will be captured within the GST net if total sales are $60,000 per year or more. This means that if you carry on other taxable activities in the same entity it will be the total of all activities including accommodation sales that is counted. In this scenario, it would be advisable to talk to your accountant and solicitor about potentially purchasing the property via another entity. If your occupancy rate increases at some point in the future, the risk of exceeding the $60,000 threshold again needs to be kept in mind . If you have a property manager, the gross tariff they receive is the amount that triggers GST registration, not the net amount that you receive in your bank account after they deduct their fees and pay expenses on your behalf. If you decide to stop the short stay accommodation and rent the property out on a long term basis instead, you will have to pay back GST on the property. This is usually at market value, although there are some exemptions. If the property has increased in value, this amount owing could come as a shock. There are some commercial structures that can minimise this risk, such as having one entity lease the property to another entity that operates the property. Other taxable activities For other commercial transactions where the land may be used for a taxable activity, it is also important to discuss the GST implications with your accountant. Together you can ensure you have a sound long term plan that takes into account any credible changes in business use or GST registration status. Putting the time and effort in upfront to think about how you are going to structure you affairs is the best way to mitigate any future negative GST impacts. This is also the best way to steer clear of any issues with GST tax avoidance legislation. With any tax planning issues you also need to consider the cost and complexity of any alternative structures and ensure that the benefits outweigh the potential risk. The IRD has a helpful guide on tax and property which you can download at https://www.ird.govt.nz/-/media/project/ir/documents/forms-and-guides/ir300---ir399/ir361/ir361-2020.pdf . Disclaimer: This post is a general discussion and does not constitute specific advice. Any concepts or ideas raised in this post should be discussed with your accountant and/or solicitor to ensure that all relevant matters are considered.

Have you recently returned from fellowship looking to buy your family home? Do you already have a rental property located somewhere in New Zealand? How can you structure your mortgages to maximise tax deductions? It is fairly common practice for junior doctors to buy a house during training. Perhaps an apartment in the city with a view to renting it out long term, or a temporary home during a posting at a regional hospital. It is great to make a start on the property ladder but what do you do when you want to buy a family home and need to take on more debt? If you simply go to the bank and ask for an additional mortgage for the new home, all the lending will be for the purpose of buying this second property. Your family home is not a business and does not generate income so you cannot claim a tax deduction on any interest associated with this mortgage. But you have the advantage of valuable equity in your rental property. How could you structure your affairs so that as much lending as possible is against the income generating asset? Assuming the first property is owned in your own name, you could create another entity: a trust or a company. We will go into the benefits and disadvantages of each in another blog; for the purposes of this example we will use a company. You could then sell the rental property to the new company. Your previous equity in the rental property would become a shareholders’ advance after settlement. For example, a property worth $500,000 with a $200,000 mortgage would be reflected in the company accounts as a $500,000 investment property asset, a $200,000 liability to the bank (loan) and a $300,000 liability to the shareholders. In summary, the shareholders have sold the property to the company but have advanced (loaned) the company $300,000 to fund the rest of the purchase. The directors of the company could then take out a new loan to pay out the shareholders’ advance up to the maximum value of the property. The rental property will then have a 100% mortgage: a $500,000 asset and a $500,000 liability to the bank. The shareholders could then use the money they received from the company to purchase the new family home, along with any additional lending required. What about security and personal guarantees? For tax purposes, it doesn’t matter what the mortgage is secured over or who personally guarantees the mortgage. Tax deductibility is determined by the purpose of the mortgage. In this case, it was to pay off another loan and this is a legitimate business activity. What the shareholders then choose to do with those funds is irrelevant. What other issues do I need to consider? You need to be aware of the bright-line test for residential property. You do not want to risk triggering the bright-line tax rule and owe income tax on the capital gain of your rental property. There are also anti-avoidance provisions in New Zealand tax law which prohibit structuring affairs for the sole purpose of avoiding tax, and some new rules that ring-fence residential rental property losses which may limit any taxable benefit. In some circumstances, there are other reasons that come into play when considering the structure described above which this post does not cover. You also need to consider the increased compliance cost required to create this structure, and the ongoing annual costs. The cost benefit analysis is different for every situation and needs to be discussed in detail with your accountant, who will tailor advice to your situation. Disclaimer: This post is a general discussion and does not constitute specific advice. Any concepts or ideas raised in this post should be discussed with your accountant and/or solicitor to ensure that all relevant matters are considered.

GST is a tax on most goods and services, excluding some things like wages, bank fees, overseas travel and interest. You have to register for GST if your turnover is greater than $60,000 pa ($5,000 per month). It is not a “cost” to your business because you are simply collecting and paying GST on behalf of the government. The cost is to the patient as they are the end consumer. Filing GST returns Once registered for GST you need to: charge GST to your customers file GST returns pay any GST you owe to IRD keep GST records Most of our medical clients ask us to file GST returns on their behalf, or you can calculate and file them yourself. You collect GST from your customers on the sale of your goods or services. You pay GST to your suppliers when you buy goods and services relating to your taxable activity. When filing your GST return, you work out the difference between the amount of GST you collected and paid. If you collected more GST than you paid, you pay the balance to IRD when you file your GST return. If you paid more GST than you collected, you can get a GST refund from IRD. Depending on your situation, GST returns can be filed monthly, 2-monthly or 6-monthly. Most of our clients file GST returns 2-monthly. For 2-monthly returns, GST is payable on the 28th of the following month. In the periods October/November and February/March there is a longer period before they are due: January 15 and May 7 respectively.